Extreme Networks rolled out a new network analytics solution called Purview, marking the first major product launch from the company since its $180 million acquisition of fellow networking vendor Enterasys in September.

Purview, which includes technology from Enterasys and Extreme, also is the first new product from Extreme to be sold through both the Extreme and Enterasys distribution channels.

“Our intention is that the partners can sell our whole portfolio of products, whether they are from legacy Extreme or legacy Enterasys. That is the go-forward plan,” said Theresa Caragol, vice president of global channels at Extreme, San Jose, Calif. “We are launching Purview — and when you are integrating companies, you still have separate order systems for a period of time — into the entire global distribution network and partner network. It is the first [Extreme] product launch within the new company to both partner bases.”

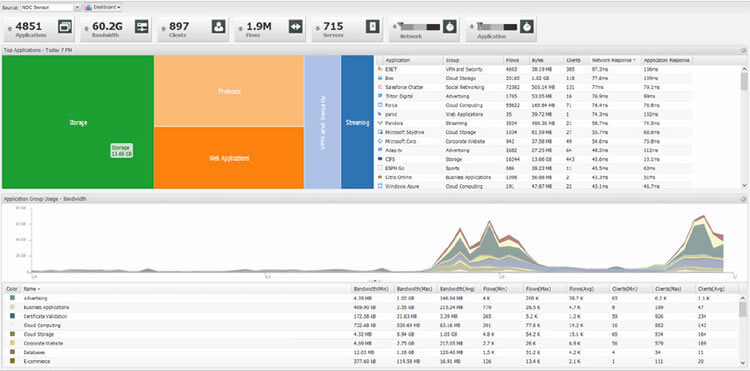

Powered by Enterasys’ CoreFlow2 ASIC technology for tracking application flow throughout a network, Purview monitors users, applications and devices as they access the network, aggregates and analyzes that information, and then turns that information into visual reports and dashboards for solution providers or IT administrators to gain quick insight into network activity.

Purview can be used, for instance, to track which applications — whether they be CRM, ERP, collaboration, email, social networking or gaming — are most widely used by either individual users or lines of business. Purview also can show how much bandwidth those applications are using to help network managers prioritize mission-critical business applications. In addition, it can be used to identify the use of applications that have not been approved by IT.

Extreme said the Purview interface consists of reports, dashboards and other common business analytics tools.

John Thome, executive vice president at Chi, a Cleveland-based solution provider that joined the Extreme channel through the Enterasys acquisition, said he “absolutely” sees customers demanding solutions such as Purview, especially given the high cost of bandwidth of today.

“People are always looking to put something in their environment to see what’s going on,” Thome said. “And the more insight you can give them, the better they can serve their customers or own end users.”

Purview is available as either a hardware or virtual appliance and can be used with other third-party networking gear. For partners selling Purview to net-new Extreme customers, Extreme said there is a bundled Purview package, under a single SKU, that includes all Purview components, such as CoreFlow, the Purview analytics engine, and NetSight, Extreme’s network management software.

Purview is the first product to combine legacy Extreme and Enterasys technology since the September acquisition. The deal, which according to some industry analysts is set to make Extreme the fourth largest Ethernet switching vendor worldwide after only Cisco, Hewlett-Packard and Huawei, was well received by both companies’ channels, given the minimal overlap between the legacy Extreme and Enterasys customer bases.

“It’s been very complementary,” Thome said. “Extreme OEMed their wireless, but Enterasys has an awesome wireless suite. Extreme has the big, 40-GbE [switches] and Enterasys didn’t. It’s going to take some time to get everything put together, but I see it as a very positive thing for the company moving forward.”

Caragol said that the combined Enterasys and Extreme North American channel consists of about 1,200 solution providers. She said that, for now, partners are still operating under either the Extreme or Enterasys partner program, but that the companies are working to integrate the programs and hope to launch a combined version at their partner conference this July.

“Right now, we are operating under both programs, but we have an integration team … that is helping to design a best-in-class program,” Caragol said. “I think it’s great to take the best of both programs, but what you really want is the best in the industry.”

Caragol also said she has seen an uptick in the number of new solution providers interested in partnering with Extreme since the Enterasys buy.

“I think people see that this is a company with a real opportunity in the marketplace,” she said.